The conversation around SaaS pricing models has become more urgent in recent years. As software spending climbs and CFOs demand clearer accountability, many businesses are questioning whether traditional subscription tiers or usage-based fees still deliver fair value. Customers increasingly want transparency and measurable ROI not just access to features or storage.

In this context, outcome-based models have gained traction as a fundamentally fairer approach. Instead of charging for licenses, users, or transactions, vendors tie their revenue directly to the customer’s measurable success. This alignment creates stronger partnerships, higher trust, and a shared focus on tangible results.

The Limits of Traditional SaaS Pricing Models

For years, most SaaS companies have relied on three dominant pricing models:

Per-Seat (Subscription-Based): Customers pay a fixed fee per user, often bundled into tiers. While predictable for vendors, this often leads to overpayment, as companies may purchase more seats than are actively used.

Usage-Based: Pricing scales with consumption, such as API calls or data processed. Although flexible, it doesn’t guarantee that higher spend translates into improved business outcomes.

Value-Based Pricing: Fees are set according to perceived product value. This is more customer-oriented, but it’s often subjective and difficult to measure consistently.

These approaches share a critical weakness: they do not directly align cost with customer success ROI. A business can continue paying large bills even when the software has little impact on core outcomes such as sales growth, churn reduction, or productivity. In today’s climate of rising SaaS costs and heightened scrutiny from finance teams, that disconnect undermines trust.

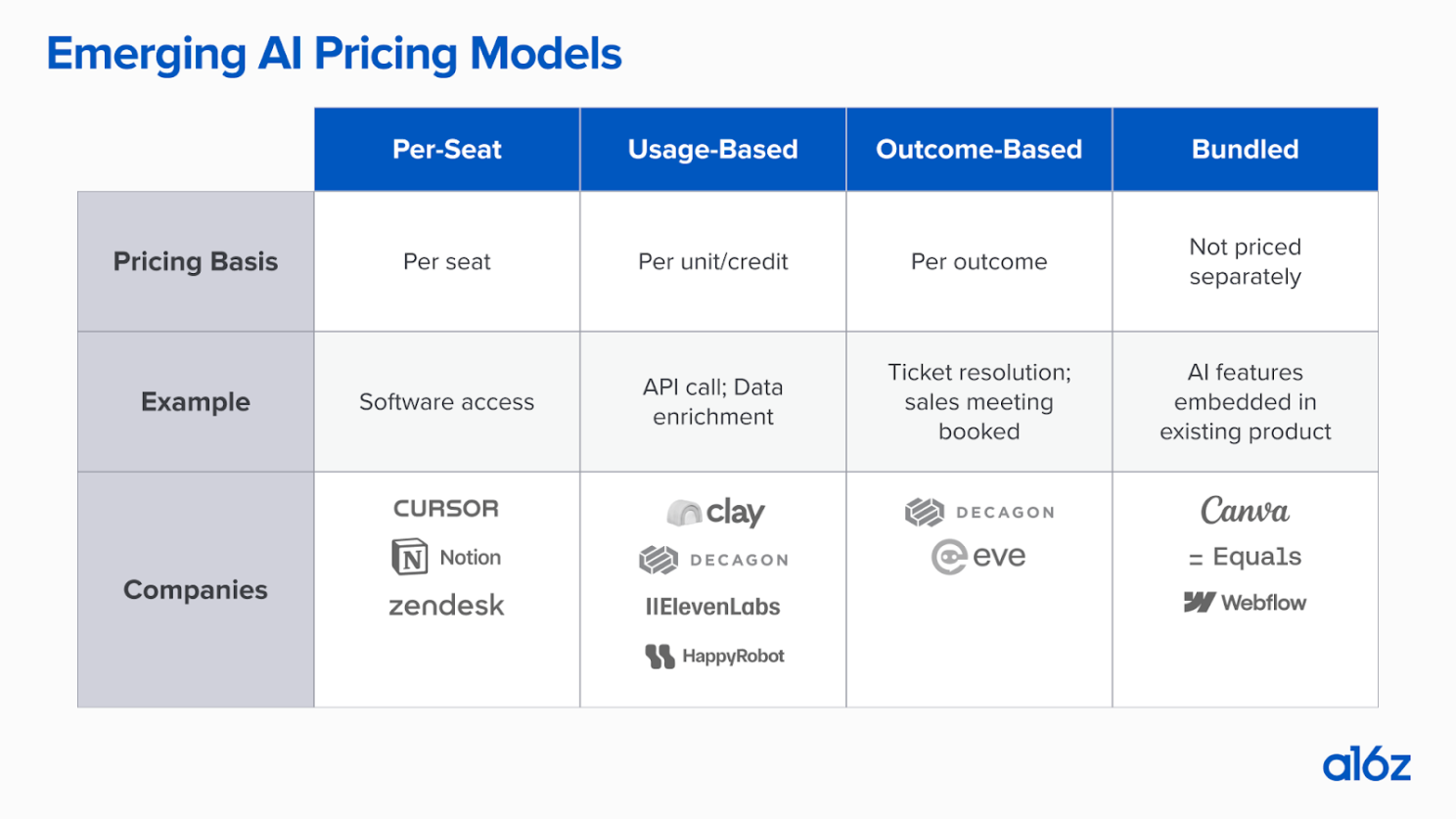

Comparison of SaaS pricing models per-seat, usage-based, outcome-based, and bundled (Source: a16z)

The chart illustrates the evolution of SaaS and AI pricing models. While per-seat and usage-based approaches remain common, they emphasize access and consumption, not outcomes. Even bundled pricing, where AI features are folded into existing subscriptions, doesn’t solve the fairness problem.

This is why outcome-based models have begun to stand apart. Unlike traditional models, they ask: “What results does the customer achieve, and how should pricing reflect that success?”

Forward-looking SaaS builders including those designing AI-powered platforms increasingly recognize that fairness depends on connecting revenue with performance. This requires new solution architectures with built-in tracking and reporting of success metrics, a shift that companies working with experienced product development partners are beginning to embed early in their design process.

Outcome-Based Models: Fairness Through Measurable Success

The defining strength of outcome-based models is that they connect what customers pay directly to what they achieve. Unlike per-seat or usage-based models that monetize access or activity, this approach monetizes results.

At its core, fairness comes from three principles:

Alignment of incentives. Vendors only grow revenue when clients see measurable gains higher sales conversions, reduced churn, faster case resolution. This eliminates the perception of “paying for nothing.”

Transparency in ROI. Outcomes are quantifiable (tickets resolved, deals closed, incidents prevented), so the link between spend and value is explicit. Finance leaders no longer need to guess at whether SaaS spend is worthwhile.

Shared accountability. Both vendor and customer have skin in the game. Success is not a marketing promise but a contractually defined performance measure.

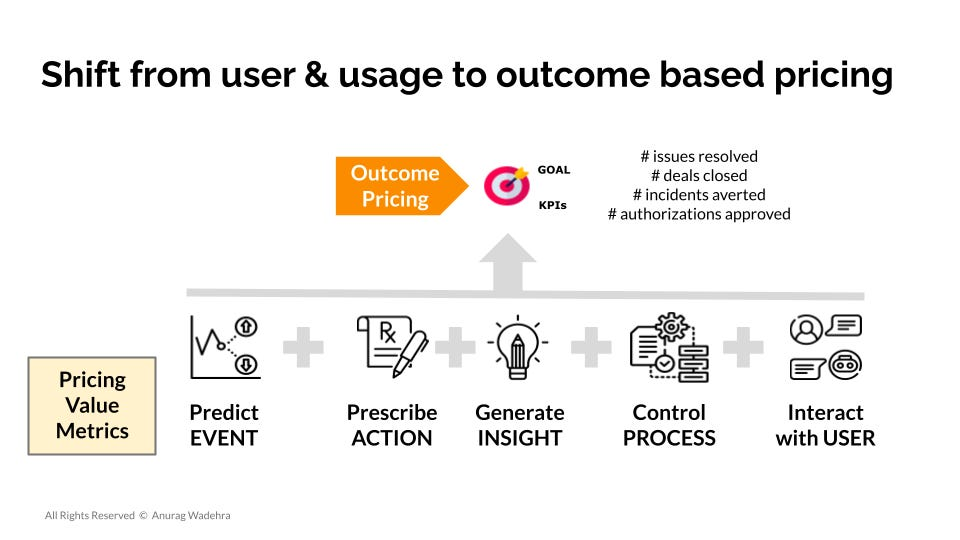

Shift from user/usage pricing to outcome-based pricing with measurable KPIs (Source: Anurag Wadehra)

This shift reflects a wider trend: SaaS pricing is moving away from user counts and consumption toward value metrics such as predictive accuracy, cost savings, compliance improvements, and customer retention. Each of these ties spend to KPIs that finance leaders can validate, making pricing inherently more transparent.

And the trend isn’t theoretical. Recent research backs it up:

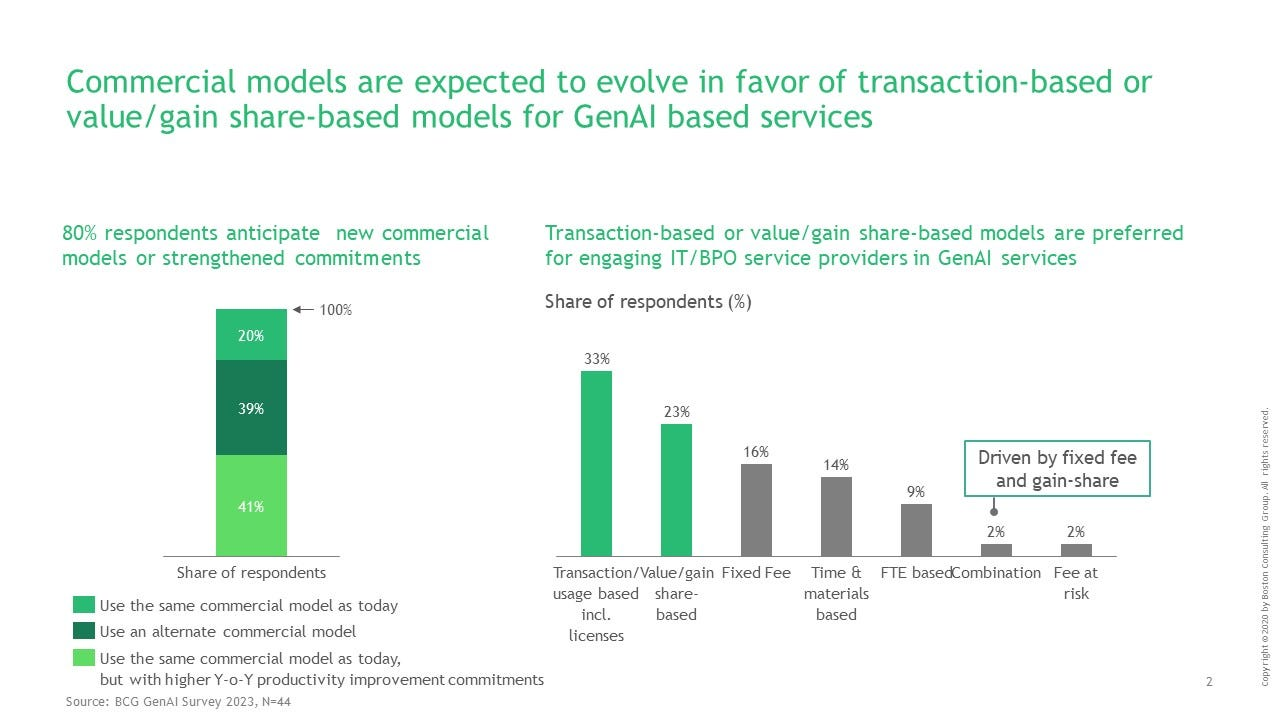

BCG 2023 survey showing enterprise preference for transaction-based and value/gain share models in IT and BPO services (Source: BCG GenAI Survey)

According to BCG’s GenAI survey, nearly a quarter of enterprises already prefer value or gain share-based models, and one-third lean toward transaction-tied pricing. In other words, businesses are actively moving away from fixed subscriptions and toward pricing structures that link spend to measurable outcomes. For ongoing analysis of SaaS pricing models and the shift toward outcome-based strategies, see the Twendee Blog Newsletter, where we break down market trends and real-world cases shaping how software is bought and sold.

For vendors, adopting this model is not just about fairness, it’s about product design. Outcome-based contracts demand the ability to track, verify, and report outcomes in real time. That means embedding analytics pipelines, attribution models, and usage-to-value reporting directly into the product. Companies that succeed here don’t just offer a fairer pricing model, they build systems where incentives stay aligned over the long term.

In short, outcome-based models transform SaaS from a recurring cost into a performance partner. Customers gain clarity on ROI, vendors gain stronger retention, and both sides share a common definition of success.

Challenges of Outcome-Based Models and the Path Forward

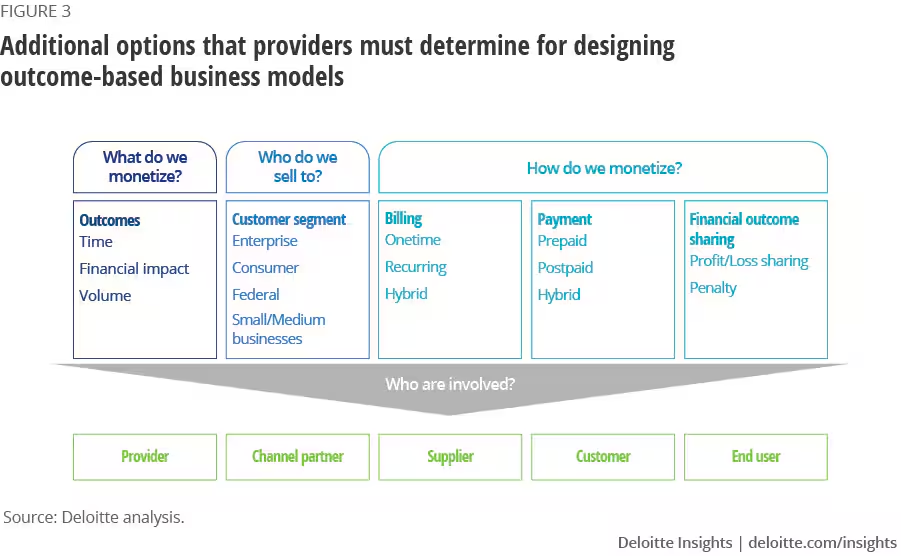

Outcome-based models promise fairness, but they are also demanding. Vendors must decide what to monetize time saved, cost reduced, or revenue generated and then align with buyers on how success is measured. Billing terms complicate things further: should payments be flat with bonuses, based on shared savings, or structured around profit-and-loss sharing? These choices affect not just revenue but also the customer relationship.

Key decision points in outcome-based pricing, including what to monetize, how to bill and which stakeholders to involve (Source: Deloitte Insights)

Adopting this model requires more than shifting invoices. Three hurdles consistently stand out:

Data infrastructure. SaaS products must capture outcomes at a granular level and make them auditable. Without this, pricing tied to results is impossible to sustain.

Metric alignment. Success must be defined in ways that are meaningful to the customer and feasible for the vendor to deliver.

Operational maturity. Revenue may fluctuate as outcomes change. Companies need financial resilience and a culture built around long-term customer success.

This is where Twendee’s role becomes tangible. Many SaaS firms in APAC and beyond are experimenting with outcome-based pricing, but most struggle with the tracking and attribution layer. Twendee’s approach when building SaaS solutions is to design the measurement system into the architecture itself integrating analytics pipelines, KPI dashboards, and usage-to-value reporting from day one. This makes outcome-based models not just a pricing strategy, but a product capability.

Firms that build this way turn complexity into credibility. They can prove value transparently, link pricing to efficiency or growth metrics, and differentiate in markets where buyers are weary of paying for shelfware. The payoff is more resilient contracts, stronger retention, and a competitive edge built on trust.

Conclusion

The debate over SaaS pricing has shifted. Subscriptions, usage-based tiers, and even value-based contracts no longer satisfy buyers who demand transparency and measurable ROI. Outcome-based models stand out as the only fair strategy because they tie price directly to results. Customers pay for proven impact, and vendors are rewarded for driving success, a balance that builds trust on both sides.

The transition is not simple. It requires data infrastructure, aligned metrics, and operational readiness. Yet companies that embrace this model now will not only meet rising demands for accountability but also gain a durable competitive advantage.

Discover how Twendee helps leading teams design SaaS solutions built for outcome-based pricing, and stay connected via Facebook, X, and LinkedIn.