Banks are accelerating digital banking upgrades to improve performance, security, and scale. Yet the biggest risks rarely come from technology itself but from banking compliance gaps that surface during system redesign and migration. When architectures change, security controls may no longer align with standards. Audit logs can break. AML and KYC workflows may behave inconsistently. And once these failures appear in production, they shift from technical bugs to regulatory liabilities. This blog outlines the five most critical compliance pitfalls and how a compliance-first upgrade strategy reduces exposure.

Why Compliance Breaks During Digital Banking Upgrades

Banks often approach digital upgrades as technical modernization projects, but the deeper risk sits in how these changes disrupt established banking compliance controls. Legacy systems were built with tightly coupled data structures, fixed authentication flows, and predictable event logging. When institutions shift to microservices, cloud environments, or new orchestration engines, the compliance mechanisms embedded in the old architecture do not transfer seamlessly.

Fragmented Data and Legacy Constraints: Legacy cores store compliance-critical information in centralized modules. Moving to distributed architectures fragments identity data, AML/KYC attributes, and transaction metadata across services, making it harder to maintain consistent regulatory logic.

Compliance Standards Do Not Map 1:1: Frameworks such as PCI DSS, ISO 27001, SOC 2, MAS TRM, and EBA Guidelines assume specific security behaviors. Once an institution adopts new encryption libraries, messaging queues, or IAM layers, these standards must be reinterpreted and rebuilt not simply copied over.

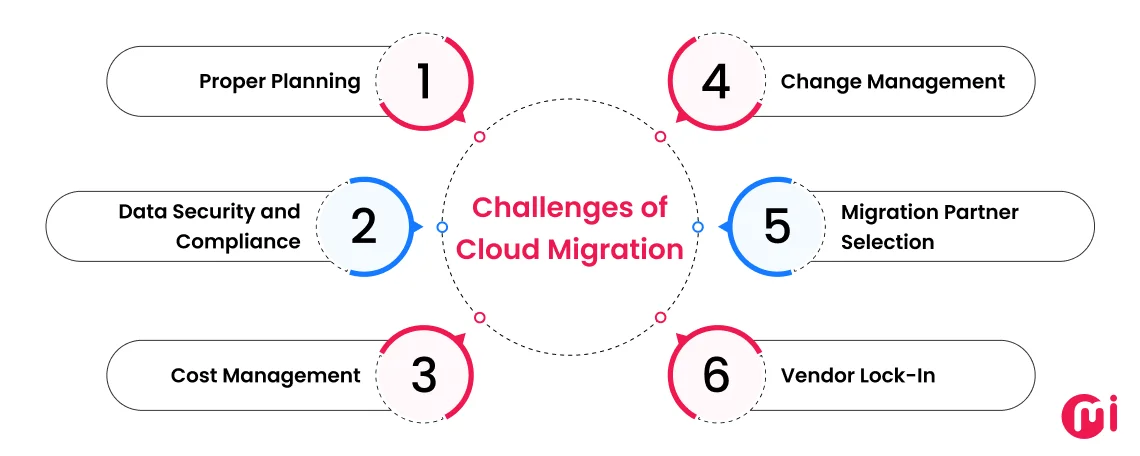

Cloud migration surfaces deeper compliance and governance risks that traditional banking systems are not designed to handle. (Source: MindInventory)

Performance Pressure Can Hide Compliance Failures: Under higher transaction volumes, digital systems may skip validations, delay screening, or drop logs especially when performance tuning is prioritized over compliance resilience. This issue often correlates with latency bottlenecks, discussed further.

Vendor Ecosystems Introduce Additional Regulatory Risks: Modern digital stacks rely heavily on external KYC partners, payment interfaces, cloud services, and fraud engines. Each integration introduces its own event formats, logging behaviors, and security assumptions, creating gaps where regulatory controls can weaken.

Migration Itself Disrupts Audit Integrity: During system migration, event IDs, timestamps, AML flags, and identity markers often transform or fail to map correctly. Even small inconsistencies can break regulatory traceability, undermining the institution’s audit readiness.

The Top 5 Compliance Pitfalls Banks Face During Digital Banking Upgrades

Compliance failures during system upgrades rarely emerge from a single mistake. They arise from structural misalignments between legacy governance models and new digital architectures. When banks modernize without embedding compliance into every technical milestone, even well-designed systems can introduce regulatory exposure. These five pitfalls represent the most common and most costly breakdowns observed in digital transformation programs.

1. Incomplete or Inconsistent Audit Logs After Migration

Audit logs underpin AML reviews, fraud investigations, and incident response. During migration, they frequently fail to align across new and legacy systems due to changes in data structures, timestamp formats, or customer identifiers.

Real precedents show what happens when evidence becomes unreliable:

Raphaels Bank (UK) was fined £1.89 million after inadequate oversight of an outsourced card-processing service led to a multi-hour outage affecting thousands of customers. A key regulatory criticism was the lack of robust controls and documentation to demonstrate operational continuity and traceability. (FCA & PRA, 2019)

TSB’s 2018–2022 remediation revealed that unclear event correlations and inconsistent system logs made post-incident analysis far more complex, according to the PRA’s subsequent findings. (PRA Final Notice, 2022)

When logs become fragmented, regulators question whether the bank can reconstruct customer activitactivity, a core element of banking compliance.

2. Security Controls That Do Not Map to the New Architecture

Upgrades often involve a shift from monolithic systems to distributed microservices or cloud infrastructure. Traditional security assumptions no longer apply, and even small mismatches can become regulatory issues.

A well-documented example is: TSB Bank’s IT migration failure (2018), which resulted in millions of customers locked out of their accounts. The FCA and PRA later fined TSB £48.65 million and cited deficiencies in operational risk management, governance, and oversight of system changes including control design that did not adequately account for the new architecture.

This case demonstrates that security failures during upgrades are interpreted not as technology accidents but as failures of governance and control mapping.

3. AML/KYC Workflows Breaking Under New Logic

AML and KYC processes depend on deterministic flows: which events trigger screening, in what order checks run, how data fields are populated, and when alerts are raised. A digital banking upgrade changes many of the assumptions under that logic:

Data models are redesigned, so risk-relevant fields may be missing, renamed, or populated later in the flow.

Message ordering changes when systems become more asynchronous, which can break rule conditions that assume a specific sequence.

Integration behavior with external KYC or screening providers may change under load, creating silent failures or timeouts.

Real-world reviews, like the recent Deloitte-led assessment at Bendigo and Adelaide Bank that uncovered widespread AML/CTF deficiencies, show how systemic weaknesses can persist for years when monitoring logic and governance do not keep pace with business and system changes.

When AML/KYC logic becomes unpredictable, regulators see not just a technology issue, but a failure to meet statutory obligations for customer due diligence and ongoing monitoring.

4. Vendor Integrations Without Standardized Compliance Requirements

Digital upgrades bring new KYC vendors, cloud infrastructures, analytics engines, and payment rails. Each introduces unique data-handling patterns. Without unified governance, this creates compliance disorder.

According to McKinsey’s 2024 Banking Operations Review, third-party modules account for 45% of compliance deviations during digital transformation, often because encryption, logging formats, or data residency rules diverge between components.

Real regulatory precedents:

The FCA’s enforcement action against TSB Bank explicitly cited vendor misalignment during system upgrade as a root cause.

ECB supervisory assessments consistently highlight “inadequate compliance harmonization across vendor modules” as a material risk category.

Regulators no longer accept the argument that “the vendor caused it.” Every gap is attributed to the institution.

5. Cutover and Load Scenarios Not Tested for Compliance Behavior

Banks typically test functionality and baseline performance, but far fewer test compliance behaviour at scale, such as AML alert generation, KYC validation, logging completeness, and fallback modes under heavy load.

The clearest example is again TSB’s migration: Regulators concluded that TSB’s migration lacked adequate end-to-end testing under realistic load and failure scenarios. When the platform went live, unexpected performance stress caused widespread service disruption demonstrating how compliance, monitoring, and customer authentication can all degrade when a system is not validated under real-world operating conditions.

This incident resulted not only in fines but also in £32.7 million in customer redress, reinforcing that weak cutover governance affects compliance, customer outcomes, and operational resilience simultaneously.

Conclusion

Digital banking upgrades expose institutions to compliance risks that often appear only after systems go live. Broken audit trails, misaligned security controls, and unstable AML/KYC workflows are not minor defects but structural gaps that regulators scrutinize heavily. A compliance-first upgrade strategy ensures modernization strengthens governance rather than weakening it. With the right migration architecture, validation phases, and international-standard controls, institutions can reduce regulatory exposure and build more resilient digital systems.

Discover how Twendee helps institutions modernize safely through international-standard digital banking systems, and stay connected via LinkedIn and Facebook.