Korea’s digital economy is moving fast, and so are the expectations on product velocity, reliability, and cost discipline. For decision-makers weighing IT outsourcing Korea strategies, six industries stand out for both urgency and upside: finance, telecom, retail, healthcare, manufacturing, and logistics. Below is a sector-by-sector analysis with data points, a core insight, and a concrete case for each, followed by how Twendee partners with Korean enterprises to turn adoption trends into measurable outcomes.

Why IT outsourcing is rising in Korea

Enterprise demand is shifting from “lift-and-shift” to outcome-based partnerships that add scarce skills in cloud, AI, data, and cybersecurity. Korea’s IT services market alone is projected at about USD 29.9B in 2025 with double-digit growth through 2030, helped by government platform strategies and hyperscaler expansion.

Cloud adoption is a major tailwind. Gartner estimates Korea’s cloud market at USD 5.0B in 2023, up 24 percent year over year, and the country is now attracting multi-billion-dollar AI infrastructure investments, such as the AWS–SK Group plan for Korea’s largest AI data center in Ulsan. These factors expand the capacity to run modern workloads and reinforce the business case for specialized partners.Korea’s BPO market tells a complementary story. Revenues were USD 2.65B in 2023, with finance and accounting leading and logistics the fastest riser through 2030, reflecting how operations and technology outsourcing converge.

1. Finance and Fintech

Korea’s financial institutions are scaling digital channels while facing four pressures at once: (i) shortages in cloud/AI/data skills, (ii) stringent security and compliance, (iii) legacy cores that are hard to change, and (iv) increasingly sophisticated fraud. As a result, IT outsourcing Korea has shifted from “staff augmentation” to outcome-based partnerships that shorten time-to-market, control OPEX, and preserve security and compliance.

2. Impact-first outsourcing workstreams

Open Finance / API platform: build gateways, consent and API analytics, and standardized data contracts to unlock use cases quickly and cut partner integration time.

Next-gen Fraud/AML: eKYC orchestration, graph/ML for real-time anomaly detection, alert triage to reduce false positives, investigation time, and loss per thousand transactions.

Core-adjacent microservices: peel off onboarding, pricing, loyalty, and credit decisioning with a strangler approach, enabling weekly releases and lowering “big-bang” core risk.

Data platform & MLOps: lakehouse, data contracts, feature store, model registry and monitoring to move AI from pilots into auditable production.

Digital ID & authentication: biometrics/passkeys and risk-based auth to lift mobile conversion while reducing account-takeover risk.

Delivery model and risk governance Adopt a hybrid model: keep architecture, product, and sensitive data in-house; add specialized partner pods to increase innovation capacity. Wrap execution in third-party risk management and compliance-by-design (network separation, encryption, access control, logging, security testing), with clear SLAs/OKRs. For the core, prefer iterative change with microservices plus automated CI/CD and SRE, not a single large replacement.

In finance, outsourcing is not cost cutting, it is controlled innovation capacity that enables rapid experimentation, safe scaling, and lower fixed costs. A leading Korean digital bank introduced core-adjacent microservices (onboarding, pricing) while upgrading its fraud stack (graph + triage). Release cycles moved from monthly to weekly, false alarms fell materially, and run costs declined through automation and better observability.

2. Telecom and the 5G/6G runway

Context. Korea is a mature 5G market moving from coverage build-out to service industrialization. Operators must deliver low-latency experiences, automate both RAN and core, and prepare for 6G timelines while controlling energy and spectrum costs. The practical bottlenecks are software and integration: cloud-native cores, edge compute at scale, AI-assisted operations, and airtight security across a fast-changing vendor stack.

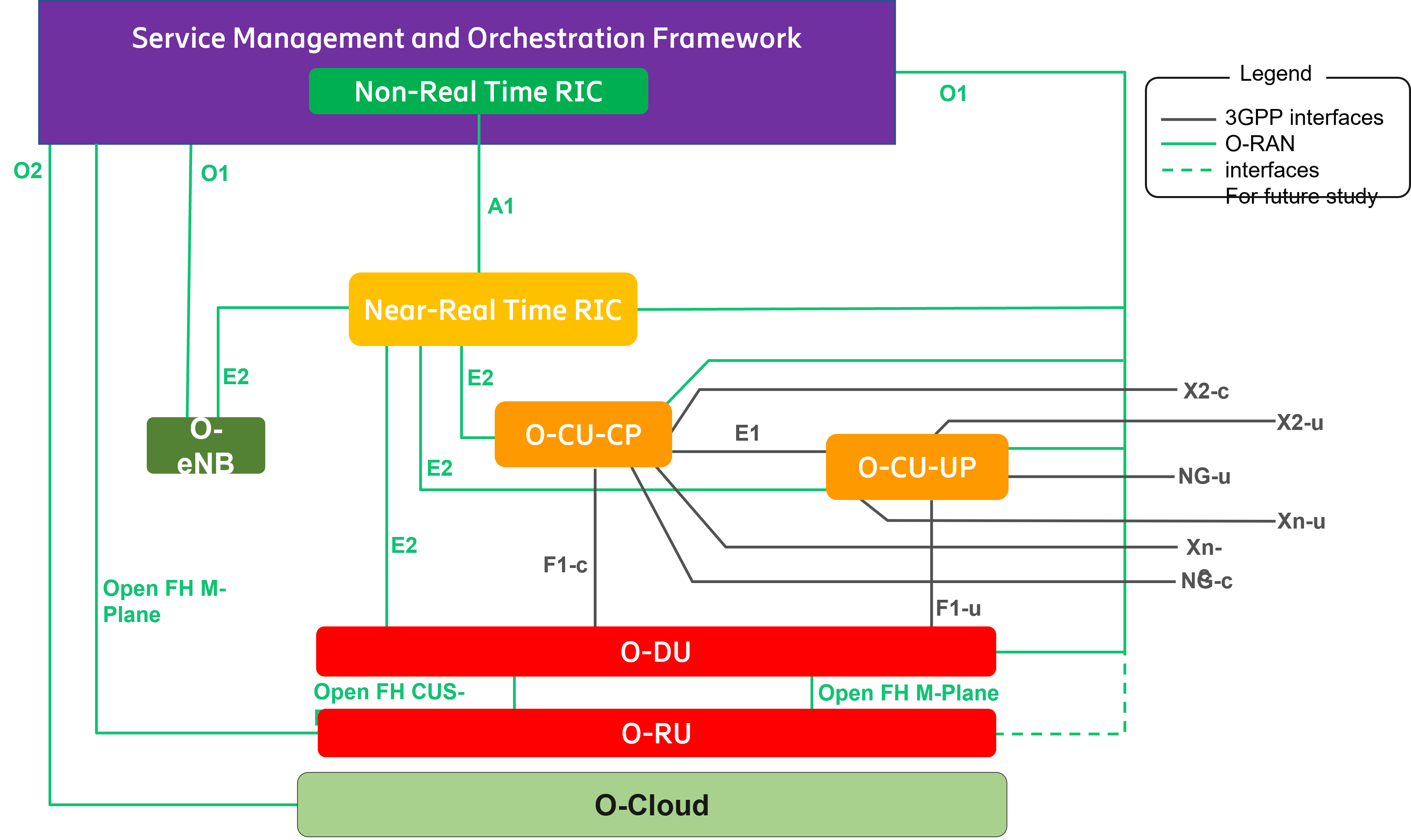

O-RAN architecture for 5G in Korea showing SMO/near-RT RIC on O-Cloud with O-CU, O-DU, O-RU and open interfaces - (source)

Impact-first outsourcing workstreams

Network cloudification & core modernization: containerized 5G core, automated CI/CD for network functions, unified observability, and zero-touch operations to raise release cadence and reliability.

MEC/edge services: co-design platforms for video analytics, AR/VR, industrial control, gaming, and smart-city workloads, placing compute close to users and radio sites.

AI-RAN & AIOps: ML-driven scheduling, interference mitigation, anomaly detection, capacity forecasting, and energy optimization to improve spectral efficiency and reduce OPEX.

Enterprise 5G (slicing & private 5G): RF planning, security policy, device onboarding, and application integration for factories, campuses, and logistics hubs.

Security & resilience: harden signaling, API gateways, and supply chains; continuous pen-testing for CNFs and MEC apps; disaster-recovery drills aligned with regulatory expectations.

Data & API monetization: safely expose network analytics, QoS events, and location signals so partners can build monetizable services.

Delivery model & governance. Adopt a multi-vendor, standards-aligned approach (3GPP/O-RAN) with a lab-to-field pipeline, canary or blue-green rollouts, and strict change control. Separate control and user planes across clouds where appropriate. Govern third parties with 3PRM, enforce secure SDLC, SBOM checks, and runtime policies, and tie contracts to SLOs on latency, jitter, throughput, and availability.

The crux of Korea’s 6G runway is less about adding spectrum and more about embracing software-defined networks and automation. Outsourcing acts as a turbocharger to deploy cloud-native cores, build a MEC ecosystem, and bring AI-assisted RAN into production while containing fixed headcount and integration risk. A telco that gets this right ships network features like software, treats edge as a product with developer-grade APIs, and runs AI-augmented operations that improve quarter by quarter, converting today’s 5G scale into 6G-era capability without letting costs spiral.

3. Retail and E-commerce

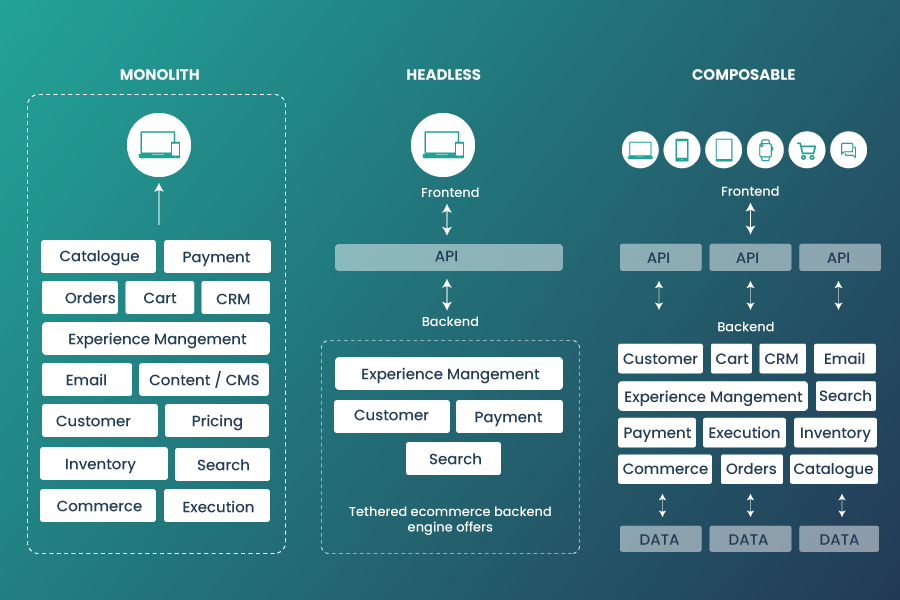

Context. Korea’s retail is mobile-first, promotion-dense, and peak-driven (flash sales, live commerce, holiday spikes). Merchants and marketplaces are moving from monoliths to composable stacks while racing to personalize experiences, synchronize inventory across channels, and compress fulfillment/returns cycles. The real bottlenecks are software and integration: headless platforms, real-time data pipelines, search/recs relevance, order and inventory orchestration, payments and trust, and airtight security under heavy traffic.

Monolith vs headless vs composable commerce decoupled frontends and API-first services for modern retail (source)

Impact-first outsourcing workstreams

Composable commerce & storefront performance: decouple monoliths into API-first services (cart, pricing, promotions), micro-frontends, edge caching; improve LCP/TTFB and stability during traffic spikes.

Data platform & personalization: event streaming, identity resolution, feature stores, experimentation/feature flags; power recommendations, dynamic pricing, and churn/CLV models.

Search, recommendations & merchandising: semantic/vector search, learning-to-rank, rules engines for campaigns and bundles; unify content (PIM) and enrichment for higher discovery and AOV.

Order & inventory orchestration (OMS/DOM): real-time stock visibility, ATP, split shipments, store/warehouse allocation, and SLA-aware promising for BOPIS/ship-from-store.

Payments, fraud & trust/safety: PSP integrations, SCA, risk scoring, chargeback management, policy enforcement and content moderation for marketplace sellers.

Logistics, returns & post-purchase: carrier APIs, route/ETA prediction, returns portals and automated triage (restock/refurbish/refund), proactive notifications to cut WISMO tickets.

Delivery model & governance. Use a multi-vendor, standards-aligned composable approach with a lab-to-prod pipeline, canary/blue-green releases, and strict change control. Enforce PCI-DSS, privacy/consent, and data minimization by design. Govern partners with 3PRM; require secure SDLC, SBOM checks, bot/DDoS mitigation, and runtime policies. Tie contracts to SLOs on page speed, availability, checkout latency, search relevance, and order-promise accuracy..

The crux of Korean retail isn’t just more tradcan, it’s turning peaks into durable advantages through software: composable commerce for speed, real-time data for relevance, and synchronized fulfillment for reliability. Outsourcing serves as the turbocharger that gets these capabilities into production quickly while keeping fixed headcount and integration risk under control.

4. Healthcare and Biotech

Context. Korea’s healthcare and biotech sectors are digitizing fast across hospitals, diagnostics, and trials. Providers are scaling telemedicine, imaging AI, and data-driven care; biopharma is expanding real-world evidence and decentralized trials. The bottlenecks are software and integration: interoperable data flows, regulated AI deployment, clinical-grade security, and validated processes that pass audits while still moving at product speed.

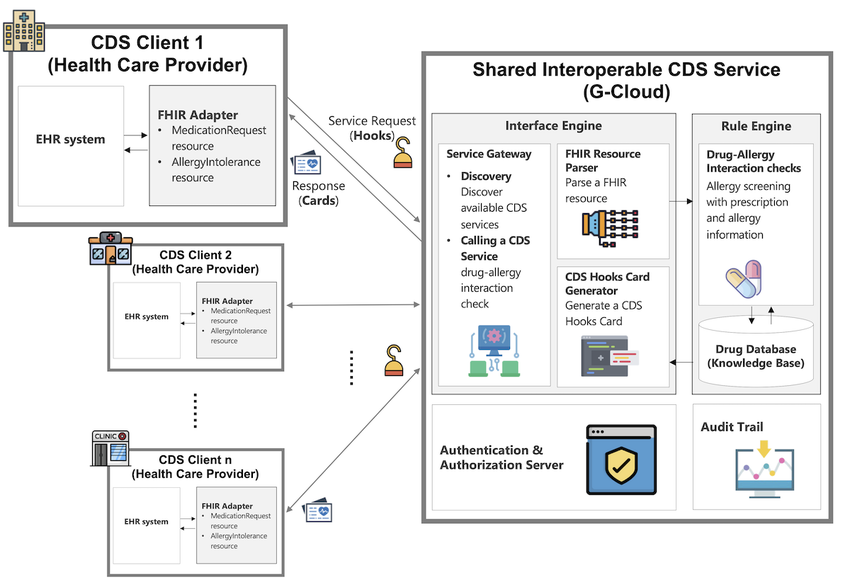

Interoperable CDS on FHIR linking multiple EHR systems with authentication, rule engine, and audit trail (source)

Impact-first outsourcing workstreams

Interoperability & clinical data pipelines: HL7/FHIR interfaces, EHR integration, consent and identity, de-identification/tokenization, longitudinal data marts for analytics and care pathways.

Imaging AI and workflow integration: PACS/VNA integration, DICOM routing, inference services, worklist prioritization, quality dashboards, and human-in-the-loop labeling to accelerate radiology throughput.

Telehealth & remote monitoring: device onboarding, vitals ingestion, alerting, care-team dashboards, reimbursement logic, and privacy-preserving storage for continuous data streams.

RWE & clinical-trial tech (CTMS/EDC/eConsent): site onboarding, protocol digitization, ePRO capture, data quality rules, SDTM/ADaM exports, and monitoring for protocol deviations.

MLOps for regulated AI: feature stores, lineage and provenance, model registry, performance monitoring, drift and bias checks, versioned rollouts, and audit-ready documentation.

Security, privacy, and compliance by design: PHI access boundaries, encryption at rest/in transit, secrets management, role-based access controls, continuous testing, and incident readiness aligned to local regulations.

Quality systems and validation: CSV/GxP processes, risk management, change control, traceability matrices, and periodic revalidation for SaMD and clinical environments.

Delivery model & governance. Use a multi-vendor, standards-aligned approach with a clear lab-to-prod pathway, canary releases, and strict change control. Separate production PHI from non-PHI environments and enforce least-privilege access. Govern third parties with 3PRM, require secure SDLC and SBOM checks, maintain audit trails, and align documentation to QMS and regulator expectations. For AI, establish model governance committees, clinical risk assessments, and defined criteria for promotion and rollback.

The core advantage in Korean healthcare and biotech is not only new algorithms but the ability to make them reliable, auditable, and integrated into clinical and trial workflows. Outsourcing accelerates that shift by supplying interoperable data plumbing, regulated MLOps, and validation discipline without adding fixed headcount. For example, a mid-sized hospital network implemented chest-imaging triage by inserting an AI inference service between the modality and PACS, adding priority flags to the radiologist worklist, and routing metrics into a governance dashboard. Within one quarter, radiology backlogs eased, high-acuity studies surfaced earlier, and validation artifacts were ready for inspection, allowing the system to scale to additional departments with confidence.

5. Manufacturing and Automotive

Context. Korea’s factories and carmakers are digitizing at speed across semiconductors, electronics, EVs, and Tier-1 supply chains. The push is clear: higher OEE, faster new-model launches, and verified traceability for export markets. The bottlenecks are software and integration rather than machines themselves: modern MES and MOM, IIoT connectivity, edge computing on lines, computer vision for quality, digital twins for scheduling, and airtight OT security that plays well with IT.

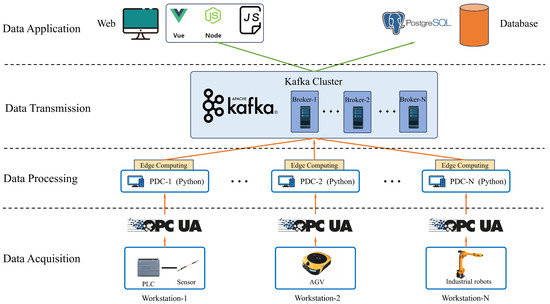

IIoT architecture with OPC UA devices, edge computing nodes, and Kafka streaming to enterprise databases (source)

Impact-first outsourcing workstreams

Smart-factory integration (MES/MOM). Map ISA-95 processes, refactor legacy MES, introduce event-driven orchestration for work orders, genealogy, SPC, and real-time KPIs at the line and cell level.

IIoT connectivity and edge. Standardize OPC UA and MQTT, normalize tags into an asset model, buffer at the edge to ride through outages, and stream to historians and data lakes for analytics.

Computer vision and predictive maintenance. Deploy line-side vision for defect detection, auto-labeling pipelines, and model monitoring; add vibration and thermal sensing with feature stores for failure prediction.

Digital twins and scheduling. Build twins of bottleneck cells and intralogistics, optimize changeover and sequence, and simulate what-if scenarios before shifting the plan on the shop floor.

ERP, PLM, and BOM change control. Close the digital thread from engineering to manufacturing, automate ECN propagation into routings and recipes, and eliminate manual rekeying.

Automotive software and vehicle cloud. Establish secure OTA pipelines, fleet telemetry, and software bill of materials; align to ISO 26262 functional safety and ISO 21434 cybersecurity, and prepare for UNECE R155 and R156.

Industrial cybersecurity. Segment IT and OT networks, enforce least-privilege remote access, continuous vulnerability scans for PLCs and HMIs, and incident playbooks aligned with IEC 62443.

Delivery model and governance. Use a multi-vendor, standards-aligned approach that respects ISA-95 and ISA-88. Run lab-to-line pilots, canary releases on noncritical cells, and strict change control for PLC and SCADA updates. Separate PHI or commercial secrets from plant telemetry. Govern partners with third-party risk management, require secure SDLC and SBOM checks, and enforce runtime policies on gateways and edge nodes. For automotive software, maintain a release calendar with staged rollouts, rollback criteria, and audit-ready traceability.

The decisive advantage in Korea is not simply more robots, it is software that synchronizes engineering, production, and logistics in real time. Outsourcing accelerates that shift by supplying the integration muscle and data discipline that plants need without adding fixed headcount. For example, a Korean Tier-1 supplier retrofitted a stamping and assembly line with OPC UA to a unified asset model, added line-side vision inference with edge buffering, and connected results to MES for automated hold and release logic. In eight weeks, first-pass yield increased by 4–5 points, scrap fell by about 15 percent, changeover time shortened by 10–12 percent, and schedule adherence improved because the digital twin could re-sequence work when a cell went into maintenance.

6. Logistics and Supply Chain

Context. Korea’s logistics network serves dense domestic e-commerce, export-heavy manufacturing, and cross-border flows through major gateways. Shippers and 3PLs are compressing fulfillment and lead times while coping with peak volatility, tight labor markets, and rising sustainability expectations. The bottlenecks are software and integration: near-real-time inventory visibility, promise accuracy across channels, slotting and labor orchestration in warehouses, routing/ETA prediction on congested corridors, reverse-logistics triage, and airtight security across a multi-party tech stack.

Impact-first outsourcing workstreams

WMS/TMS/DOM integration. Unify order promising, inventory ATP, and carrier tendering; implement distributed order management to split, re-route, and ship-from-store/DC with SLA-aware logic.

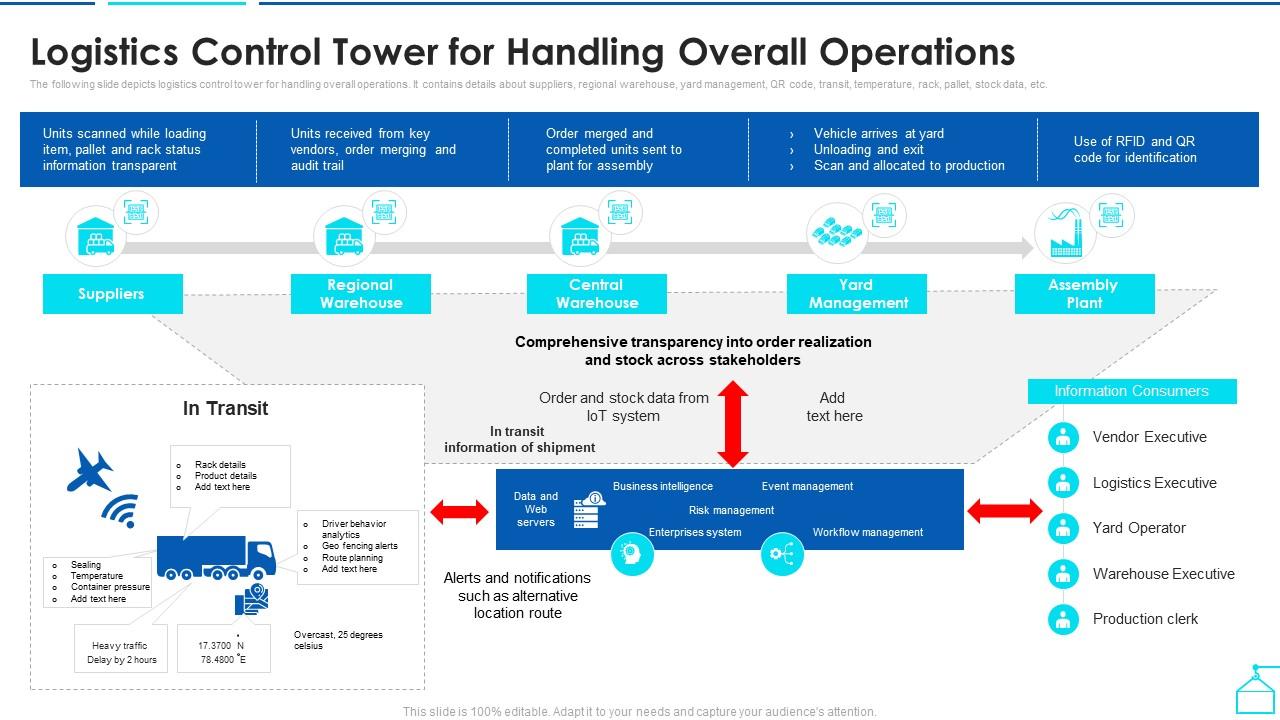

Logistics control tower linking suppliers, warehouses, yard and plant with IoT/EDI events and exception handling (source)

Control tower & visibility. Ingest EDI/API/IoT telematics, normalize events to a canonical model (e.g., GS1/EPCIS-style), surface exceptions, and automate playbooks for re-planning.

Warehouse optimization & robotics. Slotting, wave/waveless picking, labor planning, and orchestration of AMRs/ASRS; vision-assisted put-wall and pack-out with cycle-time dashboards.

Network modeling & digital twins. Simulate lane changes, hub bypass, and line-haul consolidation; optimize cross-dock rules, dwell time, and yard moves before deploying to ops.

Routing, ETA, and last-mile. Real-time dispatching, multi-stop optimization, dynamic reassignments, and customer-facing ETA with confidence; integrate returns pickups and lockers.

Customs & compliance. Automate HS classification, trade content checks, shipment documentation, and FTZ/bonded workflows; enforce data-retention and audit trails.

Reverse logistics & recovery. Rules to triage refund/repair/refurbish/restock, disposition pricing, and secondary-market feeds to protect margin.

Back-office automation. RPA for rating/audit, freight bill processing, claims, and CO2 reporting aligned to corporate sustainability metrics.

Delivery model & governance. Use a multi-vendor, standards-aligned approach: support EDIFACT/ANSI X12 for partners while exposing modern REST/GraphQL for internal apps; apply data contracts and versioning. Run lab-to-prod pilots with canary/blue-green cutovers, and define RTO/RPO for control-tower and WMS components. Govern third parties with 3PRM, require secure SDLC and SBOM checks, enforce least-privilege access at the warehouse edge, and bind contracts to SLOs on event timeliness, order-promise accuracy, carrier response latency, and platform availability.

Advantage in Korean logistics comes from turning physical flow into software-defined flow: promising only what the network can deliver, then continuously replanning as conditions change. In one engagement, a national e-commerce network connected store/DC inventory to a DOM, added control-tower visibility (API/EDI/IoT), and piloted AMR orchestration in the busiest DC. Within ten weeks, promise accuracy rose from ~96% to ~98.7%, pick-to-ship time fell ~22%, empty miles dropped ~9% through smarter consolidation, and WISMO contacts per order declined meaningfully as customer-facing ETAs stabilized. The same templates then rolled out to regional hubs with minimal disruption, locking in speed, reliability, and cost discipline for peak season.

An Effective Approach to Outsourcing in Korea

Korean enterprises are converging on proven models: faster feature delivery, strict security/compliance, and disciplined costs. Twendee focuses precisely at these intersections with enterprise-grade integration, data, and security.

With hybrid sourcing, internal teams keep architecture and core domains while Twendee’s cloud/data/AI pods plug in to expand innovation without adding fixed headcount made easier by Korea’s cloud momentum and open-finance policies.

At the AI, data, and security-by-design layer, we provide reference architectures for data platforms, MLOps, and governance aligned to local regulations in finance/healthcare and operational needs in telecom, manufacturing, and logistics.

Engagements are outcome-based and right-shored: SLAs tied to release cadence, reliability, and unit cost; work hours aligned to Korea with bilingual product leadership and flexible scaling to protect uptime and control spend. We start with a discovery sprint, then build–operate–transfer, under continuous observability and clear governance.

Conclusion

Korea’s growth leaders are using outsourcing as a strategic multiplier: ship faster, stay secure and compliant, and keep costs under control across finance, telecom, retail, healthcare, manufacturing, and logistics. The bottleneck is no longer hardware, it is software and integration at scale.

Twendee partners with Korean enterprises through hybrid sourcing pods, cloud and data architectures with security by design, right-shored delivery aligned to local timelines, and outcome-based SLAs that tie work to measurable business results. If speed, reliability, and cost discipline are on your agenda, partner with Twendee. Book a discovery session to map a focused 90-day plan and turn your roadmap into working software with clear, auditable impact by connecting via Facebook, X, and LinkedIn.

Read our latest blog here: Outcome-Based Models Are Now the Only Fair SaaS Pricing Strategy