South Korea’s digital economy is advancing rapidly, from 5G and smart cities to AI adoption. Yet this progress brings mounting cyber risk. State-linked attacks, ransomware, and IoT vulnerabilities have turned cybersecurity into a national priority.

This is why managed security outsourcing Korea has become the fastest-growing demand in the outsourcing sector. In-house teams can’t match today’s threat scale, while managed security service providers (MSSPs) offer 24/7 protection, regulatory alignment, and scalable expertise.

Why Korea’s Security Landscape Demands Outsourcing

South Korean businesses operate in a perfect storm of rapid innovation and intense geopolitical pressure. This environment has created three core challenges that make expert security outsourcing less of a choice and more of a critical necessity.

Relentless State-Sponsored Threats For over a decade, South Korea has been a primary target for sophisticated hybrid warfare. North Korea-linked cyber groups relentlessly attack the nation's most critical sectors from financial institutions and supply chains to government agencies. Their advanced operations are designed to bypass traditional defenses, making constant, expert vigilance essential.

The Crushing Weight of Compliance The regulatory environment is just as demanding. Strict laws like the Personal Information Protection Act (PIPA) and mandates from regulators like the Financial Supervisory Service (FSS) carry severe penalties. A single compliance failure can result in crippling fines of up to 3% of total revenue, transforming cybersecurity from an IT task into a major business continuity risk.

The Inherent Risk of Innovation As a global leader in 5G, IoT, and Industry 4.0, Korea’s digital transformation has exponentially expanded the attack surface. Every smart factory sensor, cloud workload, and mobile application becomes a potential entry point for attackers. The sheer scale and complexity overwhelm even the most capable in-house security teams, making it impossible to maintain visibility and control.

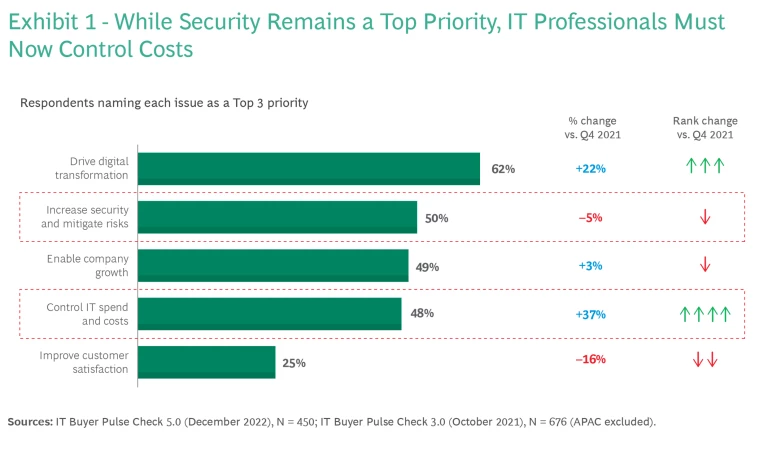

IT leaders rank security as a top priority while also facing cost control pressure (Source: IT Buyer Pulse 2022).

A recent IT Buyer Pulse survey highlights the same tension Korean businesses face: 50% of leaders still rank security as a top-three priority, yet controlling IT spend has surged by 37% compared to 2021. This dual pressure makes it difficult for in-house teams to cope, pushing companies toward outsourcing models that balance resilience with cost efficiency.

This convergence creates a stark reality: the traditional model of in-house, perimeter-based security is fundamentally broken in the Korean context. The fight is asymmetrical; businesses are pitted against state-sponsored adversaries and automated threats that operate at a scale no single enterprise can match. This is why the conversation has shifted from mere defense to active cyber resilience the ability to anticipate, withstand, and recover from attacks. For Korean companies, embracing cybersecurity outsourcing is no longer just about offloading a task; it's about leveling the playing field and securing the freedom to innovate without being crippled by the risks that come with it.

The Forces Driving MSSP Growth in Korea

The surge in managed security outsourcing in Korea is not the result of a single trend. It’s the product of converging forces escalating threats, shifting market priorities, rapid digital expansion, and rising regulatory pressure. Together, they are making managed security service providers (MSSPs) the backbone of Korea’s digital economy.

1. Korea’s Unique Exposure to Relentless Cyber Threats

South Korea sits on the front line of Asia’s cyber battlefield. According to KISA, the country recorded over 1.4 billion attempted intrusions in 2023, ranging from ransomware against banks to targeted espionage on technology firms. Some attacks were linked to state-backed groups such as Lazarus, which stole hundreds of millions in crypto assets in 2024 alone, much of it traced to South Korean platforms and exchanges. This isn’t a periodic flare-uup, it’s a constant drumbeat of pressure that makes the country one of the world’s most attacked economies.

For most enterprises, building an in-house security capability to withstand adversaries operating at this scale is simply not viable. Staffing a 24/7 security operations center (SOC) requires hundreds of analysts and multi-million-dollar budgets. MSSPs bridge this gap by pooling expertise and infrastructure across clients, delivering industrial-scale monitoring, intelligence sharing, and rapid response capabilities that no single organization could sustain alone.

2. From Tools to Services: A Shift in Priorities

For years, South Korean companies responded to new risks by adding more security products firewalls, endpoint software, monitoring dashboards. But this created fragmented “tool sprawl” that was costly to maintain and often left gaps. According to Mordor Intelligence, firms are now prioritizing services that deliver throughput gains of up to 25%, focusing on outcomes rather than more tools.

MSSPs succeed because they flip the model. Instead of buying another product, companies pay for results faster detection, quicker response, and compliance-ready evidence. This outcome-driven approach explains why security services demand is rising faster than any other segment of South Korea’s IT services market.

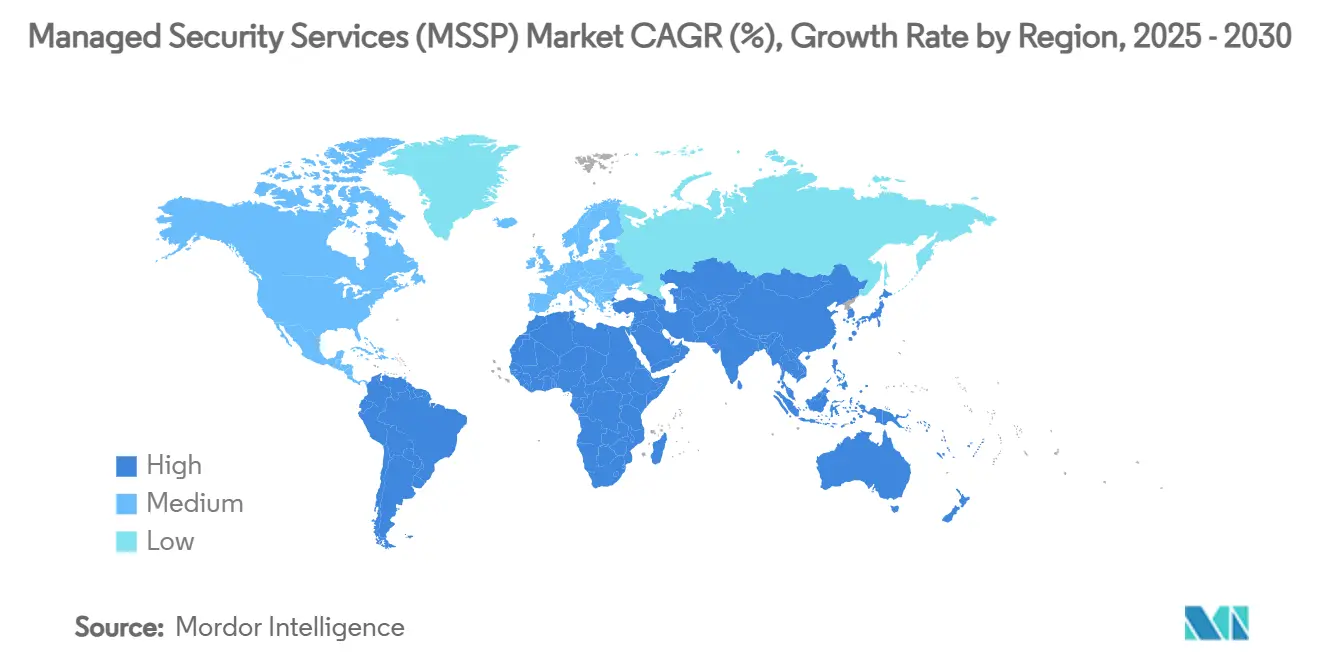

Asia-Pacific projected to lead global MSSP growth rates between 2025 and 2030 (Source: Mordor Intelligence).

According to Mordor Intelligence, the Asia-Pacific region is projected to see some of the highest global MSSP growth rates between 2025 and 2030, surpassing North America and Europe. South Korea is at the heart of this momentum, with enterprises leading the regional pivot from tools to services.

3. Digital Growth Outpaces Internal Capacity

South Korea is scaling its digital economy at breakneck speed. Massive investments in smart cities, nationwide 5G, and over $5B in new AI-driven data centers are multiplying the number of connected devices and workloads. Each one is a potential entry point for attackers, creating an attack surface that is expanding far faster than enterprises can staff and secure. Statista projects the country’s cybersecurity services market will more than double from USD 675M in 2024 to USD 1.66B by 2033 reflecting just how urgent the demand has become.

The challenge is that internal security teams cannot realistically keep pace. Recruiting and training specialists takes years, while the risks are multiplying every quarter. This is where MSSPs step in, offering capabilities that in-house departments struggle to build:

Elastic coverage – scale monitoring across thousands of devices and workloads without delay.

AI-driven detection – filter massive telemetry flows to spot threats faster than human-only teams.

Industry-specific playbooks – tailor defenses for sectors like finance, telecom, and healthcare, where downtime or data loss carries systemic consequences.

For South Korean enterprises, this flexibility makes innovation safer instead of riskier ensuring digital growth does not come at the expense of security.

4. Regulation Turns Security Into a Boardroom Priority

South Korea enforces some of the toughest cybersecurity rules in Asia. The Personal Information Protection Act (PIPA) requires explicit consent for data use and cross-border transfers, while the Financial Supervisory Service (FSS) monitors financial institutions closely. Non-compliance can cost up to 3% of annual revenue, as seen in the ₩134B fine against SK Telecom in 2022025, a clear signal that security failures now carry real financial consequences.

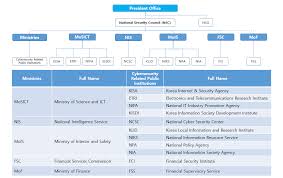

What makes this environment especially challenging is the breadth of oversight. Cybersecurity is regulated by multiple ministries and agencies, from the Ministry of Science and ICT (MoSICT) to the National Intelligence Service (NIS) and the Financial Services Commission (FSC). Agencies such as KISA, NCSC, and FSS all play roles in shaping standards, auditing firms, and enforcing penalties (see Figure 1). For enterprises, this creates a complex regulatory web where even one gap in compliance can trigger costly investigations.

South Korea’s multi-agency regulatory structure for cybersecurity (Source: Inter-American Development Bank).

This complexity explains why more executives are turning to cybersecurity outsourcing as a governance strategy. MSSPs not only provide technical defenses but also embed encryption, logging, and audit-ready reporting into their services. That makes regulatory alignment a built-in outcome, giving boards confidence that obligations across multiple regulators are being met.

Each of these forces threat escalation, outcome-driven expectations, digital expansion, and compliance risk feeds into the others. The more Korea builds its digital economy, the greater the threats; the greater the threats, the higher the cost of failure; and the stricter the compliance, the stronger the case for outsourcing.

This is why security services demand is rising faster than any other outsourcing segment. MSSPs are not a temporary solution; they are becoming the structural backbone of Korean enterprises’ resilience in the years ahead.

Many executives in South Korea remain cautious about managed security outsourcing. Their concern isn’t just cost, it’s the fear of losing visibility over critical systems. But outsourcing, done correctly, doesn’t reduce control. It can strengthen resilience while ensuring oversight remains firmly with the enterprise.

Effective partnerships build this balance in from the start:

Certified standards ensure operations are independently audited.

Clear SLAs define measurable outcomes like detection and response times.

Shared oversight keeps governance with the enterprise while MSSPs manage day-to-day execution.

Industry practice is shifting toward hybrid models that preserve governance while adding external scale. Rather than treating outsourcing as a binary choice, enterprises are working with partners that provide both technical assurance and strategic guidance. Twendee contributes in this area through QA/security testing and DX consultancy, helping organizations design outsourcing arrangements that reinforce security oversighoversight, an approach aligned with insights from our blog on hybrid outsourcing models.

Conclusion

South Korea’s surge in managed security outsourcing marks a structural change in how enterprises approach risk. Escalating cyber threats, expanding digital infrastructure, and strict regulation have made MSSPs central to enterprise resilience. The real challenge now is ensuring that outsourcing delivers scale and speed without eroding governance.

As Korean enterprises navigate this shift, working with trusted partners such as Twendee provides the confidence that security outsourcing can be aligned with both regulatory obligations and boardroom expectations.

Discover how Twendee supports Korean enterprises, and stay connected via Facebook, X, and LinkedIn.