Over the past two years, AI has shifted from experimentation to execution. Yet as enterprises rush to modernize their technology stack, one obstacle consistently derails digital transformation: no one knows the real cost and timeline of building an AI-ready platform. Most leaders underestimate the work required, misjudge vendor capabilities, or budget based on traditional software assumptions. The result is predictable: overstretched budgets, stalled roadmaps, and AI initiatives that never reach production. This article provides a 2025 industry benchmark that brings clarity to what enterprises should realistically expect when planning an AI-ready platform across eight major sectors.

Why AI-Ready Platform Development Needs a 2025 Benchmark

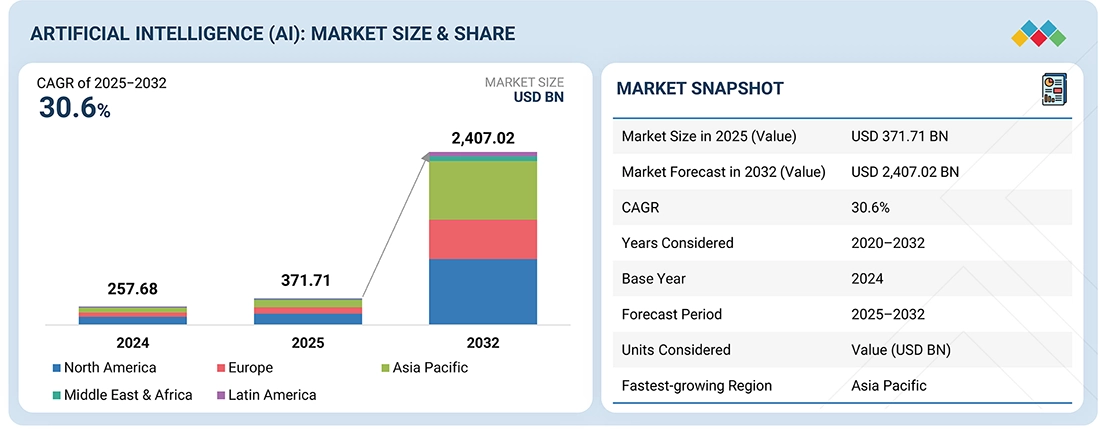

Global AI chip market growth highlights rising infrastructure costs essential for AI-ready platform development. (Source: MarketsandMarkets)

Traditional software development is no longer a reliable reference point. An AI-ready platform requires a fundamentally different foundation: unified data pipelines, an API-first architecture, robust MLOps, observability layers, compute scalability, continuous retraining workflows, and compliance-aligned audit trails. These components alone account for 25–40% of total development cost and extend delivery timelines by several months compared to conventional builds.

Across industries, Twendee has observed a consistent pattern: most organizations enter the planning phase with inaccurate expectations. They often benchmark against “feature development time,” but ignore the structural layers that allow AI to function reliably at scale. As a result, initial quotes frequently exclude data engineering, AI infrastructure, model deployment workflows, and GPU provisioning, the very elements that define AI readiness. A benchmark is no longer optional; it has become a prerequisite for budget accuracy, vendor alignment, and transformation velocity.

Build an AI-Ready Platform Across 8 Industries

Below is the consolidated benchmark for the eight industries where AI-ready platform development is most in demand. Each sector presents its own data complexity, regulatory pressure, and AI use-case landscape, all of which significantly shape cost and delivery time.

1. Healthcare & MedTech

Estimated Cost: USD 450,000–1,200,000 Timeline: 10–18 months

Healthcare is the most demanding environment for AI-ready platform development because every layer of the system must balance technical complexity with clinical safety and regulatory responsibility. Clinical data is fragmented across HL7/FHIR files, free-text physician notes, imaging records, and legacy EMR outputs, and unifying these sources into a reliable foundation often consumes 20–35% of total effort. Interoperability adds further weight, as many hospitals still operate outdated systems that require custom connectors and stringent security enforcement to ensure data integrity.

Development in this sector moves at the pace of compliance. HIPAA, GDPR, and local medical-data regulations impose strict requirements for encryption, auditability, identity governance, and consent tracking. These reviews run parallel to engineering but inevitably extend delivery by 3–5 months, as every architectural change must pass legal and clinical scrutiny. The consequences of non-compliance from project shutdowns to multimillion-dollar penalties make governance a structural element of the platform, not an optional layer.

AI in healthcare also demands a higher standard of accountability. Diagnostic support, triage automation, and predictive-care models must provide explainability, allow clinician oversight, and include continuous drift monitoring. These safeguards introduce additional workflow layers that increase cost and timeline but are essential for clinical trust and adoption.

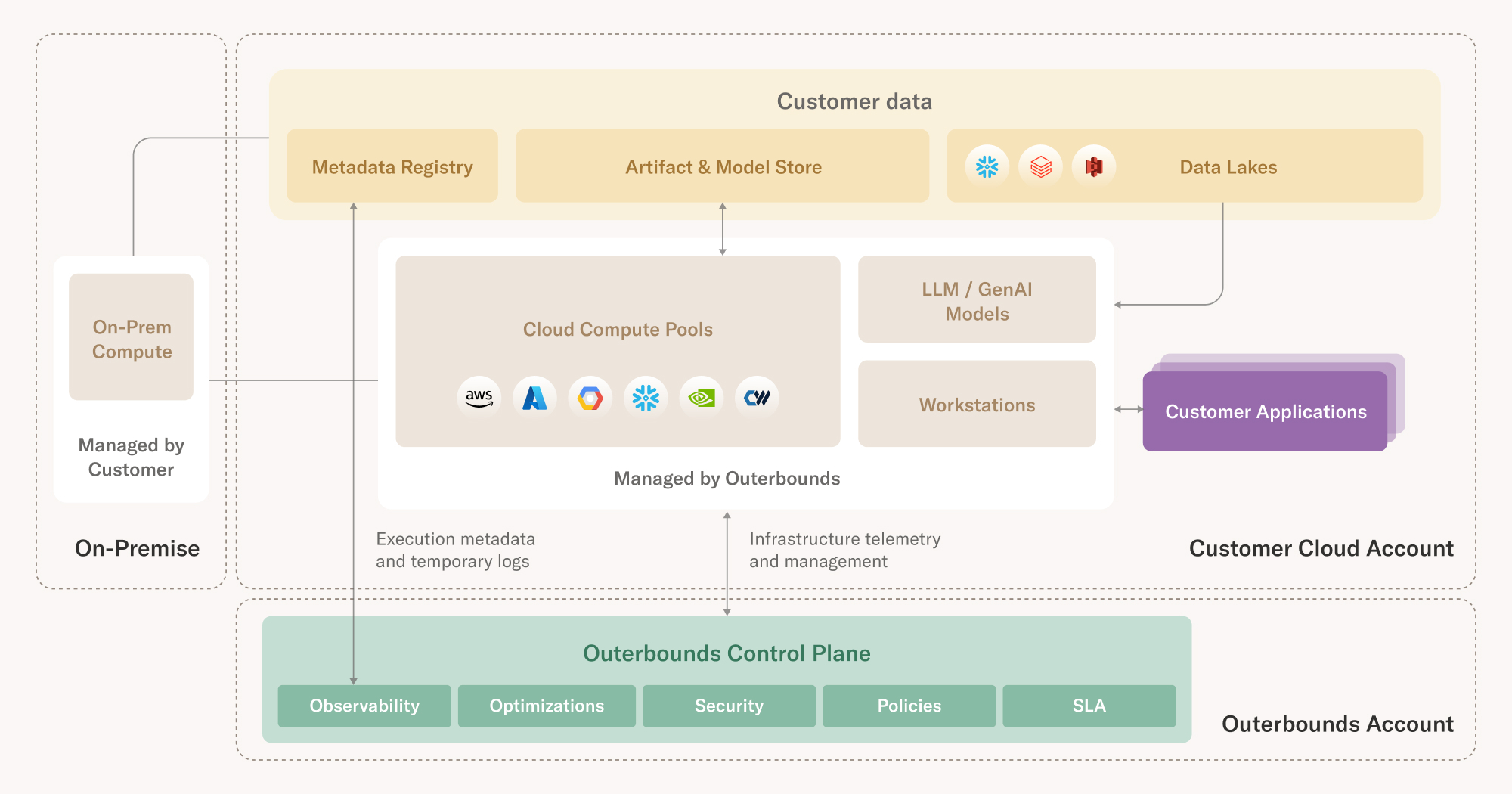

AI-ready platform architecture showing data lakes, model store, compute pools, and control-plane orchestration across industries. (source: Outerbounds)

When organizations underestimate these realities, delays and overruns become unavoidable. Compliance gaps discovered late force rework; vendors lacking healthcare expertise misjudge data-integration effort; and clinicians resist tools that cannot justify their recommendations. As these issues compound, budgets escalate and transformation timelines slip by six to twelve months, often exceeding the cost of proper benchmarking from the start.

Healthcare platforms cost more and take longer because they sit at the intersection of data complexity, regulatory rigor, and clinical accountability. A precise, industry-specific benchmark is not just helpful, it is the only safeguard against costly missteps in one of the most sensitive sectors to build for.

2. FinTech & Digital Banking

Estimated Cost: USD 350,000–900,000 Timeline: 8–14 months

FinTech platforms sit at the intersection of financial risk, strict regulation, and real-time performance requirements, making AI-ready development both complex and unforgiving. Every architectural decision must support accuracy, traceability, and continuity expectations that significantly elevate cost compared to standard digital products.

A major effort driver is the sensitivity and volume of financial data. Transaction logs, identity records, behavioral signals, and fraud indicators originate from multiple systems, and unifying them into a secure, low-latency data layer typically consumes 10–20% of the timeline. Integration adds more weight, as many institutions depend on legacy banking cores or vendor-managed gateways that require custom orchestration and rigorous compliance alignment.

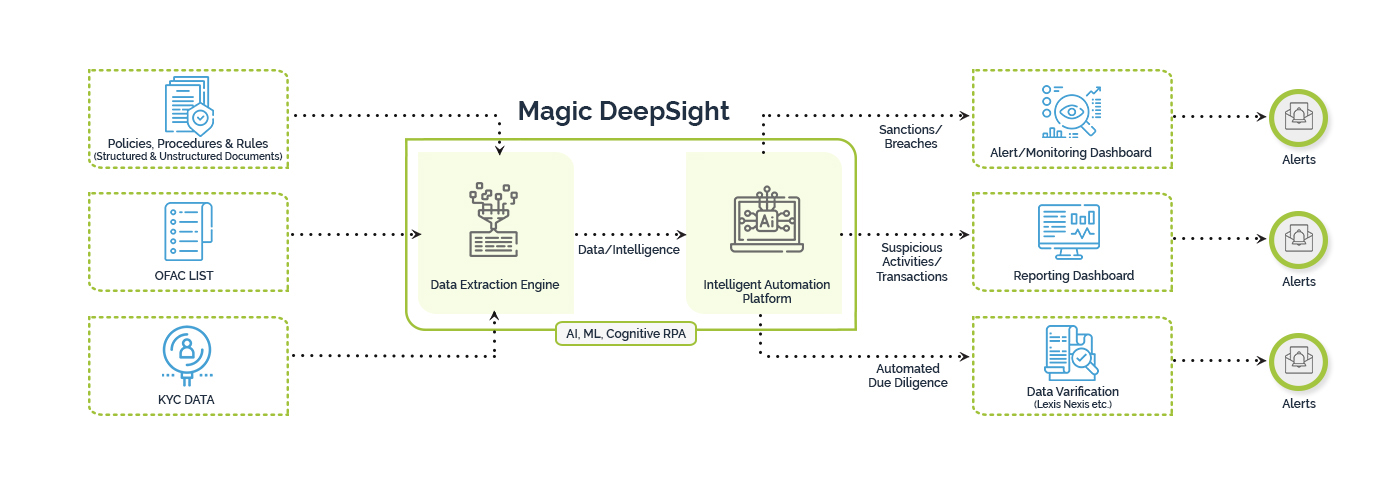

AI-driven KYC/AML workflow showing data ingestion, automated risk detection, and compliance monitoring. (source: Magic Finserv)

Regulation further shapes delivery. KYC/AML standards, transaction-monitoring rules, and local banking laws demand strict data lineage, auditability, and model explainability. These reviews often extend development by 2–4 months, as each AI-enabled decision must withstand regulatory scrutiny. The cost of misalignment is high, ranging from penalties to operational restrictions.

AI workloads such as fraud detection, credit scoring, and risk classification require low-latency inference, transparent justification, and continuous drift monitoring. Supporting both automation and human-review workflows increases operational complexity and infrastructure cost.

Without a realistic benchmark, organizations routinely underestimate compliance automation, governance effort, and integration constraints. Vendors lacking financial expertise misjudge legacy-system behavior, causing rework and delays of four to eight months. In some cases, platforms require redesign after failing regulatory assessments.

FinTech platforms ultimately cost more and take longer because they operate under regulatory pressure, zero-tolerance risk thresholds, and real-time decision demands. Accurate benchmarking is essential to avoid overruns and guide financial institutions through AI-enabled transformation with confidence.

3. Retail & eCommerce

Estimated Cost: USD 220,000–600,000 Timeline: 6–12 months

Retail and eCommerce platforms require AI-ready foundations that can interpret shifting customer behavior, unify fragmented data sources, and support real-time decisioning at scale. While the sector is less regulated than Healthcare or FinTech, its complexity lies in data volume, personalization demands, and high-velocity operations all of which influence cost and timeline.

Most retailers operate with siloed datasets spread across POS systems, CRM platforms, inventory tools, marketing automation, and third-party marketplaces. Consolidating these into a consistent customer and product data model often consumes 15–25% of development effort, especially when historical data must be cleaned for AI-driven forecasting or recommendation engines. Integration work is equally heavy, as brands frequently manage a mix of legacy ERP systems and modern SaaS tools that must synchronize in real time.

The business pressure for AI performance is also distinct. Recommendation engines, dynamic pricing, demand forecasting, and customer-journey automation require fast inference pipelines and experimentation frameworks. This necessitates an architecture capable of A/B testing, feature-store updates, and rapid model deployment capabilities that increase engineering scope even when compliance requirements are light.

Without accurate benchmarking, retailers often underestimate the effort required to unify data sources or maintain real-time accuracy across channels. Vendors misjudge integration volume, especially when legacy inventory systems or outdated POS hardware create bottlenecks. As a result, projects commonly face 3–6 month delays, budget growth tied to unplanned data engineering, and inconsistent AI performance at launch.

Retail platforms cost more and take longer not because of regulatory burden, but because they operate in fast-moving, data-heavy environments where customer experience and operational precision depend on reliable AI signals. A sector-specific benchmark helps retailers plan realistically, prevent overspending, and deliver AI features that scale with market demand.

4. Logistics & Supply Chain

Estimated Cost: USD 300,000–750,000 Timeline: 7–13 months

Logistics and supply chain platforms require AI-ready architectures capable of processing high-velocity, multi-source operational data while supporting real-time decisions. Unlike consumer sectors, where AI enhances experience, logistics AI directly impacts cost, speed, and delivery accuracy, making data reliability a core business requirement.

Data fragmentation is the primary driver of cost. Shipment logs, telematics streams, warehouse sensors, ERP outputs, and partner APIs all follow different structures and refresh cycles. Harmonizing them into a time-aligned data layer typically absorbs 20–30% of development effort, with integration complexity increasing further when older WMS or routing engines require custom orchestration.

AI workloads such as ETA prediction, route optimization, and capacity forecasting place additional pressure on infrastructure. These models must deliver low-latency decisions and refresh continuously; even small inaccuracies cascade into missed SLAs, higher carrier costs, and reduced fulfillment performance.

Without a realistic benchmark, enterprises commonly underestimate integration depth or the effort needed to stabilize data feeds affected by weather, traffic, seasonality, and partner inconsistencies. Vendors unfamiliar with supply chain dynamics often misjudge these constraints, leading to three to six months of delays, rising engineering costs, and unreliable AI behavior during rollout.

Logistics platforms take longer and cost more because they operate as real-time coordination systems, synchronizing data, decisions, and physical movement across unpredictable variables. Accurate benchmarking is essential to set practical budgets and ensure AI delivers measurable operational gains.

5. Education & EdTech

Estimated Cost: USD 150,000–380,000 Timeline: 5–9 months

EdTech platforms typically achieve AI readiness faster and at lower cost than heavily regulated industries, but they still require a solid data foundation and scalable learning workflows. The sector’s complexity stems less from compliance and more from content variability, user-behavior diversity, and the need for adaptive intelligence across large learner populations.

Most education providers operate with fragmented datasets spread across LMS systems, assessment tools, content libraries, and engagement platforms. Consolidating these into a unified learner profile or competency model usually consumes 10–20% of the timeline, especially when historical performance data is inconsistent or incomplete. Integrations with third-party content systems, proctoring tools, or district-level data sources add further effort, though generally less demanding than in enterprise environments.

AI use cases such as personalized learning paths, automated grading, content recommendations, plagiarism detection, and behavior analytics require reliable feedback loops and continuous model updates. While these workloads are less latency-sensitive than logistics or FinTech, they still demand careful orchestration to ensure fairness, accuracy, and student trust.

Without accurate benchmarking, EdTech teams often underestimate the engineering required to maintain content alignment, normalize disparate assessment formats, or support AI features at scale. Vendors unfamiliar with academic workflows misjudge the effort involved in competency mapping or institution-level integrations, leading to unexpected costs and launch delays.

EdTech platforms ultimately deliver faster and more cost-efficient AI readiness because they operate with lighter regulatory constraints, but success still hinges on building clean learner data models, stable integration paths, and AI features that adapt meaningfully to diverse learning patterns. A realistic benchmark helps organizations size the effort correctly and avoid rework as their user base grows.

6. Real Estate & PropTech

Estimated Cost: USD 200,000–500,000 Timeline: 6–12 months

PropTech platforms contend with fragmented, inconsistent real estate data spread across MLS feeds, brokerage tools, property-management systems, and public registries. While regulatory pressure is lighter than in FinTech or Healthcare, AI-ready development still hinges on data normalization and dependable multi-system integrations. Consolidating these disparate sources into a unified property dataset or pricing model typically consumes 15–25% of the project timeline, especially when historical records contain gaps or conflicting attributes.

AI use cases valuation models, price prediction, listing verification, contract intelligence, and personalized recommendations rely heavily on data precision. Even small inconsistencies can distort model outputs, weakening user trust and market credibility. Integration complexity also persists: many brokerages operate outdated software that requires custom ETL pipelines and careful data validation.

Without a realistic benchmark, organizations often underestimate the effort required to reconcile regional data variations or maintain valuation accuracy at scale. Vendors unfamiliar with real estate workflows misjudge integration depth and algorithm sensitivity, leading to cost overruns, delayed releases, and unstable AI performance.

PropTech platforms reach AI readiness faster than regulated industries, yet still demand disciplined data engineering and robust integration frameworks. A sector-specific benchmark allows teams to plan accurately, avoid rework, and deliver AI capabilities that genuinely strengthen transparency and decision-making in the property market.

7. Manufacturing & Industry 4.0

Estimated Cost: USD 400,000–1,000,000 Timeline: 9–16 months

Manufacturing platforms demand AI-ready architectures that ingest high-frequency sensor data, integrate with legacy operational technology, and support real-time decisions on the production floor. The challenge comes from diverse data sources, strict uptime requirements, and AI models that directly influence physical processes.

Factories produce continuous telemetry from PLCs, SCADA systems, IoT sensors, and quality-control devices. Converting these signals into a unified data layer typically consumes 20–30% of development effort, especially when older equipment lacks modern interfaces. Integrating MES, ERP, and routing logic adds further complexity, requiring custom connectors and precise synchronization to avoid workflow disruption.

AI applications predictive maintenance, anomaly detection, yield optimization, defect classification must run with low latency and integrate cleanly into operator workflows. Small inaccuracies can halt production or reduce yield, increasing the need for strong monitoring and rapid model updates.

Without a benchmark, organizations often underestimate the work required to stabilize data from aging equipment or align AI outputs with real operational conditions. Vendors inexperienced with industrial systems misjudge integration constraints, leading to cost overruns and months of delay, particularly during plant testing.

Manufacturing platforms cost more and take longer because they sit at the intersection of high-volume telemetry, legacy system integration, and mission-critical operations. A clear benchmark helps leaders budget accurately and deploy AI that enhances productivity without disrupting the factory environment.

8. Hospitality & Travel

Estimated Cost: USD 180,000–420,000 Timeline: 6–10 months

Hospitality and travel platforms require AI-ready architectures that personalize experiences, optimize pricing, and manage fluctuating demand across multiple channels. While regulation is lighter than in Healthcare or FinTech, complexity arises from high-volume behavioral data, diverse partner systems, and the need for fast, accurate decisioning across booking and operations.

Data is often scattered across PMS systems, booking engines, CRM tools, OTAs, loyalty programs, and on-site operations. Unifying these into a coherent guest or demand model typically consumes 10–20% of effort, especially when partner data is inconsistent. Integration work is also significant, as many hotels and travel operators still rely on outdated PMS or scheduling systems that require custom connectors.

AI use cases demand forecasting, revenue optimization, personalization engines, sentiment analysis, and automated service workflows depend on timely, accurate signals. Even small inconsistencies can weaken pricing strategy or guest satisfaction, making reliable data pipelines and continuous model tuning essential.

Without an accurate benchmark, teams often underestimate the effort required to harmonize multi-channel data or stabilize legacy integrations. Vendors unfamiliar with hospitality workflows misjudge how latency or poor data quality impacts AI recommendations, leading to budget expansion, launch delays, and underperforming features.

Hospitality platforms reach AI readiness faster than heavily regulated sectors, but success still relies on clean data models, strong integrations, and AI tuned to dynamic, experience-driven operations. A realistic benchmark helps organizations plan effectively and avoid costly rework.

Conclusion

Building an AI-ready platform is no longer a purely technical initiative; it is a strategic investment whose cost and timeline differ sharply across industries. What consistently separates successful transformations from projects that run over budget or fall behind schedule is not the sophistication of the technology, but the ability to accurately size the effort from day one. Every sector carries its own constraints: regulatory scrutiny in Healthcare and FinTech, data fragmentation in Retail and PropTech, real-time coordination in Logistics and Manufacturing. When these realities are underestimated, organizations enter predictable cycles of redesign, vendor misalignment, and multi-month delays.

A clear, industry-specific benchmark provides the foundation for realistic planning, disciplined budgeting, and informed vendor selection. It ensures that AI initiatives grow sustainably rather than collapse under hidden complexity. In an environment where competitive advantage increasingly depends on intelligent systems, a grounded benchmark is not just helpful, it is the first safeguard against transformation risk.

Discover how Twendee helps leading teams build AI-ready platforms with predictable timelines and transparent cost structures through industry-specific consulting and structured delivery. Stay connected via Facebook, X, and LinkedIn.

Read our latest blog: Top 5 Software Development Trends Every Business Must Adapt to in 2025